Investment Manager Diversity

At Seattle Foundation, we not only work to maximize returns and maintain standards of fiduciary care, we also seek to increase the diversity of our active investment managers by pursuing more women and people of color for those roles. We are dedicated to appointing the best possible managers, with proven track records, while ensuring no one is excluded due to implicit biases. Our effort to grow diversity among our investment managers aligns with the Seattle Foundation’s mission to ignite powerful, rewarding philanthropy to make Greater Seattle a stronger, more vibrant community for all. It also reflects our vision for a region of shared prosperity, belonging, and justice, where all individuals and communities have equitable access and outcomes, regardless of race, place, or identity.

In May 2018, our Board of Directors formalized Seattle Foundation’s commitment to inclusive investment management practices. As recommended by our Investment Committee, the Board adopted a Diverse Manager Policy focused on engaging more asset management firms owned by women and people of color across our investment portfolio. In collaboration with Seattle Foundation’s investment consultant, Crewcial Partners, we are tracking and reporting on our progress and experiences as we continue to increase the number of diverse managers in our portfolio.

Progress Report

Growth in the Diversity of Our Investment Managers

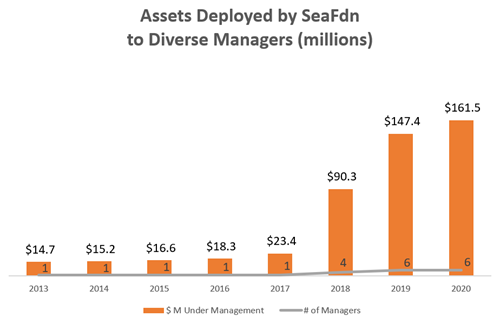

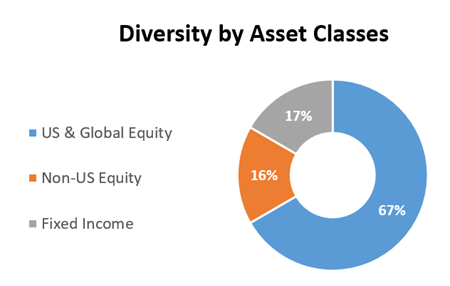

When Seattle Foundation first began tracking the diversity of our investment managers in 2013, we employed only one minority- and/or woman-owned asset management firm, with whom we had invested $15 million. Since then, we have been collaborating with Crewcial Partners to identify and engage more minority- and woman-owned firms, adding two additional diverse managers in both 2018 and 2019. By the end of 2020, we had deployed $161 million to six woman- and minority- owned firms across a variety of asset classes.

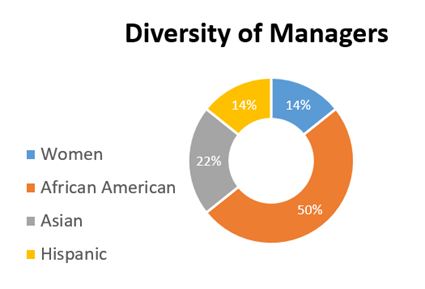

We define a minority-and/or woman-owned investment management firm as one in which 51% of more of ownership identifies as Asian, Black, Latino, Pacific Islander, Native American, or female. We also include managers located anywhere in the world and categorize non-U.S. firms as diverse if they identify as women or non-white men who are racial minorities in their country of residence.

Crewcial Partners

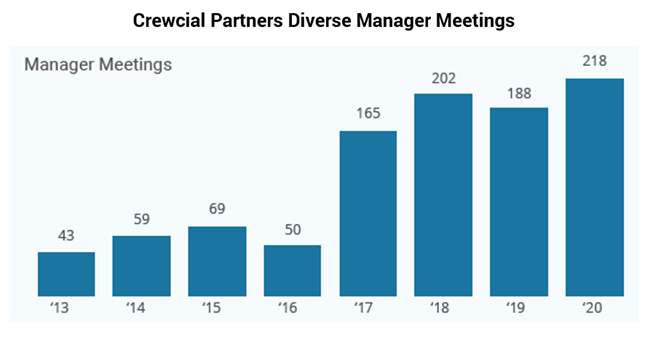

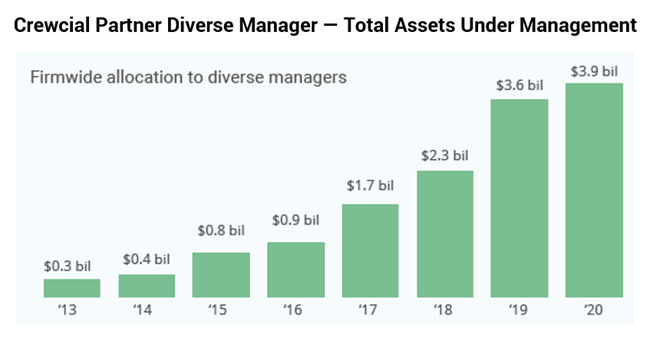

As our investment advisor, Crewcial Partners, collaborates with Seattle Foundation to identify prospective minority- and woman-owned firms for potential future investments. Between 2013 and 2020, Crewcial met with a total 994 minority- and woman-owned firms. Over time, Crewcial has experienced a dramatic difference in its ability to identify and recommend diverse investment managers to its clients. In 2013, before Crewcial became intentional in their efforts, only 11 diverse managers were recommended, seven of whom (64%) were hired. In 2020, Crewcial recommended 4 diverse managers, all of whom were hired. Collectively, assets managed by diverse managers in Crewcial Partner’s network totaled $3.9 billion, an 388% increase from five years prior.

Looking Ahead

Going forward, Seattle Foundation will continue to diversify our investment manager pool through three primary activities.

Engagement: Crewcial Consultants will continue reporting, at least annually, on its efforts to expand its universe of managers to include firms with diversity in ownership.

Measurement: Each year Crewcial Consultants will deliver a report on Seattle Foundation’s minority- and/or woman-owned managers, detailing performance and other parameters.

Reporting: When proposing new managers, Crewcial Consultants will continue to provide information on the firm’s diversity within both its leadership and its ownership, as well as the firm’s own Diversity Initiatives.